Three Ways to Attract Gifts of Appreciated Securities

Stock giving is on the rise for nonprofit organizations of all sizes. Experts say that this is not just because of the current solid market but that donors are catching on to the fact that it is an intelligent way to give.1

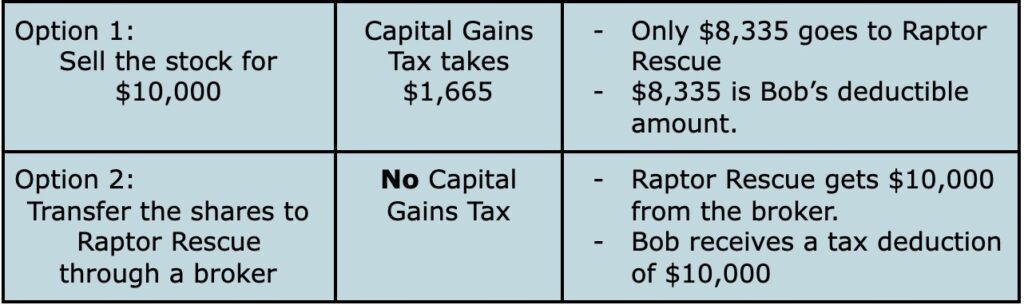

Financially savvy donors know that, by directly transferring you a gift of appreciated stock, they can avoid capital gains taxes while also maximizing their gift’s impact.

For example, Bob Donor owns $10,000 in Apple stock. So to make a tax-deductible gift to Raptor Rescue (his favorite cause), he has two options:

12021 Stock Report, FreeWill

So how do nonprofits engage and educate donors on why stocks are one of the most tax-savvy ways to give? Marketing and personal contact. Here are three strategies for driving an increase in stock donations.

3 ways to drive stock giving

1. Marketing: Enhance your website.

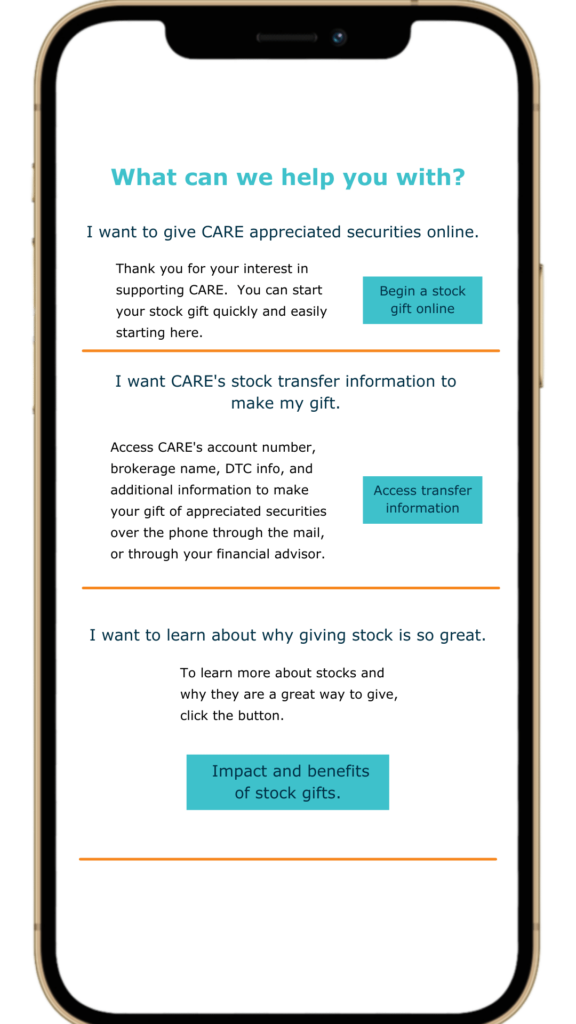

When donors visit your website with the intent of making a gift–or even if they’re just visiting–they should see information about stock giving.

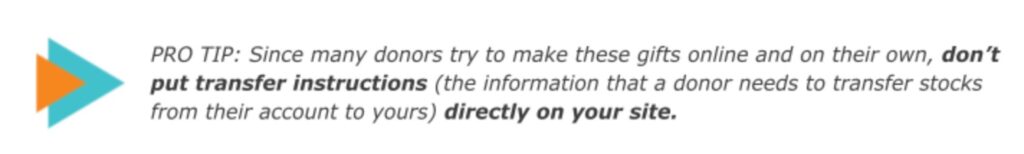

Collect Donor Information First

BEFORE sharing transfer instructions, collect donor information by using a form that asks for their name, stock ticker, and the date they intend to make the transfer. Once they complete the form, then reveal the transfer instructions.

Using a form will:

- Prevent you from receiving gifts without donor information (putting an end to delays in processing & gift acknowledgment).

- Help fundraisers follow up with donors who didn’t complete the transfer.

- Reduce the risk of fraud.

2. Marketing: Educate your supporters about tax-savvy options across multiple communication channels.

- Use channels like email, direct mail, and social media to educate your donors about stock giving benefits and ease. They will then make a more intelligent choice when they’re ready to give.

- Send educational messages with higher frequency to all of your supporters. They need to hear a message several times before they take action. You can do this in a regular fundraising email, a newsletter, or even as a postscript, presenting stock donations as one of several ways to give.

- Educate your supporters about the tax benefits of stock gifts throughout the year.

The majority of stock gifts tend to come during end-of-year fundraising. They’ll use your guidance to make that type of gift when the benefits feel the most relevant.

3. Personal Contact: Enrich your donor conversations.

- Your fundraisers need to become very familiar with the tax benefits and processes for making these gifts. When approaching these conversations, they should communicate three things:

- Giving stock is uncomplicated.

- There are significant advantages to giving stock instead of cash

- The easy steps to making a stock gift

- Work the opportunity of giving stock into every conversation, answering common questions. Avoid jargon and complexity around tax savings. Instead, keep it simple and answer the donor’s questions.

Common Donor Questions About Making Stock Gifts

- Why is stock better than cash?

- How will this gift make a bigger impact?

- What will you do with the stock?

- How do I make the transfer?

- What are your DTC and account numbers?

- Make sure there are clear next steps. For example, fundraisers should send a follow-up note to their donors to reinforce engagement and reiterate stock-giving opportunities.

An engaged and educated donor will be motivated to give you these more impactful gifts and help you drive more substantial long-term fundraising results.

DID YOU KNOW: Each DonorSearch screening includes the insider stock ownership and financial data that indicate your best stock gift prospects?

Get a Free Screening and Demo